Validate Your Privacy, Landing Pages, and Analytics

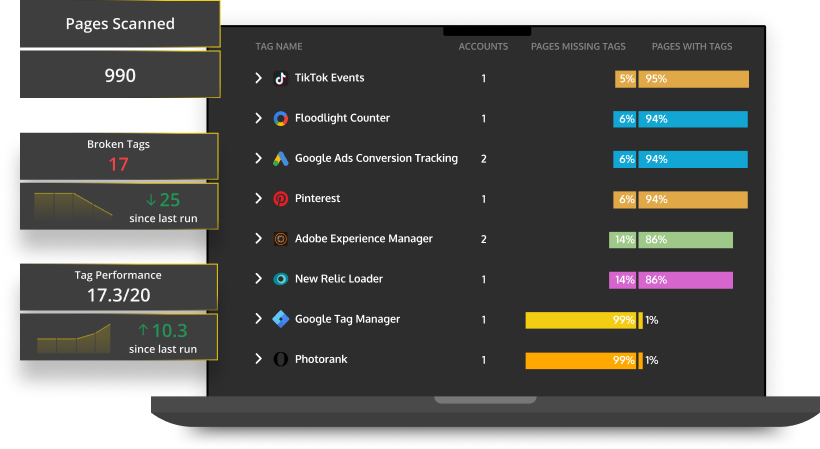

See all cookies, tags, data collection points, broken pages, and more across your entire site.

Your web questions, answered.

(without 10 new QA headcount.)

For the Privacy & Compliance Wiz

Audit your cookies and data collection technologies to know what data is being collected, who is collecting it, and where they are sending it.

For Marketers

Ensure all your customer experiences online are smooth & seamless by auditing for tech breakdowns that interrupt your ideal customer journey.

For the Analyst

Know your tags are present and properly firing on every page in just a few minutes - without carving out days of manual audit time.

See How It Works

Customer Stories

How Finning Automates Efficient & Secure QA

“With ObservePoint, I’m able to reassure stakeholders that errors won’t pop up and that the integrity of their reports will be sound.”

- Senior Marketing Analyst

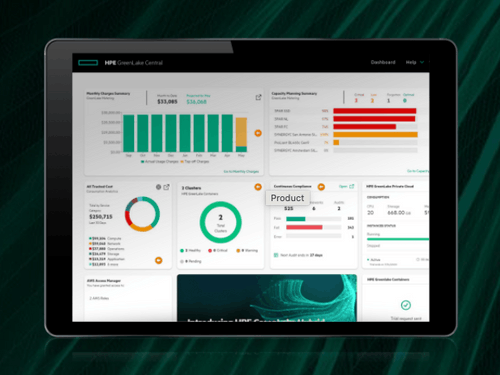

How HPE Cleaned Up Their Website Data

“There are so many ways that things can go wrong. ObservePoint gives us a way to make sure things get done and stay in place.”

- Senior Manager, Digital Analytics

How Carnival Made a Smooth MarTech Migration

“ObservePoint has been really central to our success here at Carnival since the beginning.”

- Head of Global

Marketing Technology

Businesses see 432% ROI from ObservePoint. Here’s how:

Improved personalization and customer experiences - leading to 5-7% conversion rate growth, with 20% of that growth directly attributable to ObservePoint.

2023 Research on website pages, tags, and cookies!

Did you know the average company has 17.75 cookies and 45.50% of those are 3rd party cookies?

Avoiding wasted advertising budget - by testing functionality of links and tags to recapture 75% of wasted ad spend.

Let’s Get You Started Saving Time & Money with ObservePoint - for free.

Access your free account today and start scanning your website.

Or, to learn more about ObservePoint, check out our Resource Library.